Higher corn prices carryover from 2021, but for how long?

This article has been updated for 2022. To see the latest information on this topic, read Higher corn prices continue but for how long?

Following a strong run in 2021, corn futures remain near the upper end of their historical price range. To protect these prices, producers can utilize a contract like the ADM Average Seasonal Price (ASP) to forward price a percentage of expected production during a seasonally strong time of year.

By taking advantage of an ASP contract, you will benefit from:

- Diversifying your grain marketing portfolio

- Leveraging an automatic execution component in your grain pricing program

- Capturing seasonal price advantages, rather than reactively selling on emotion

- Maintaining the control to “price out” if you see prices trending lower

The primary objective of any grain marketing strategy should be to protect and enhance farm profitability. Including ASP contracts in a marketing program has delivered a strong return on investment (ROI) over time, providing a challenging benchmark for other grain marketing alternatives in the mix.

The past

While past performance is no guarantee of future returns, the most recent 10-year period may prove instructive, especially if 2022 returns to a more “normal” pattern.

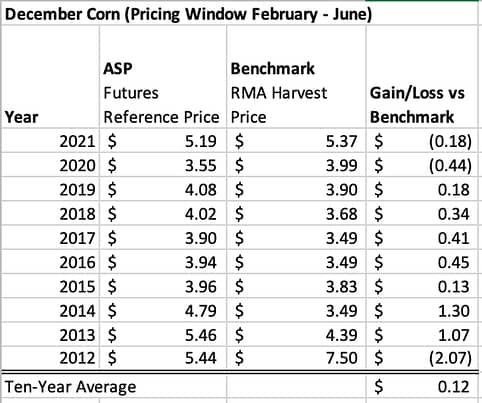

From 2012-2021, the average return for the ASP contract compared to the harvest price is 12-cents/bushel (Table 1). This simply means that by sticking to this strategy over the years, a producer would have gained an average of 12-cents in the futures component of the price vs selling at harvest – that’s $24/acre if you raise 200-bushel corn!

Table 1: 10-year-average ASP performance

Further analysis shows how the extraordinary drought year of 2012 alters this comparison. That year, the harvest Price was a historically high $7.50/bushel and the ASP was less by $2.07/bushel.

These outlier years are rare, though, and excluding 2012 from this analysis shows an average return for the ASP contract of 36-cents/bushel compared to the harvest Price. Regardless, both comparisons show the importance of a consistent strategy for gains over time, and a diversified grain marketing portfolio in years when the market doesn’t do what it “normally” does.

The future

According to recent USDA projections, 2022 is setting up as a more “normal” year. This scenario has tended to benefit the ASP strategy in the past.

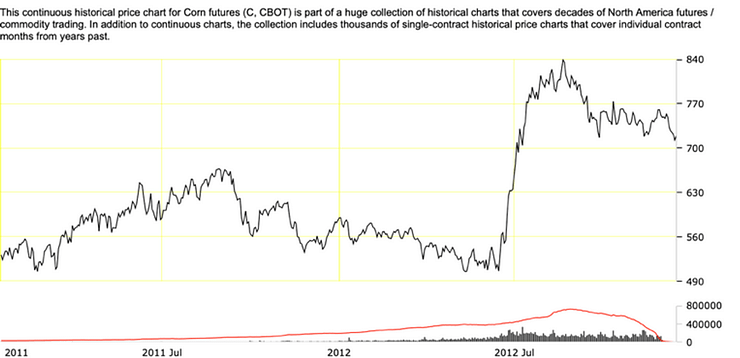

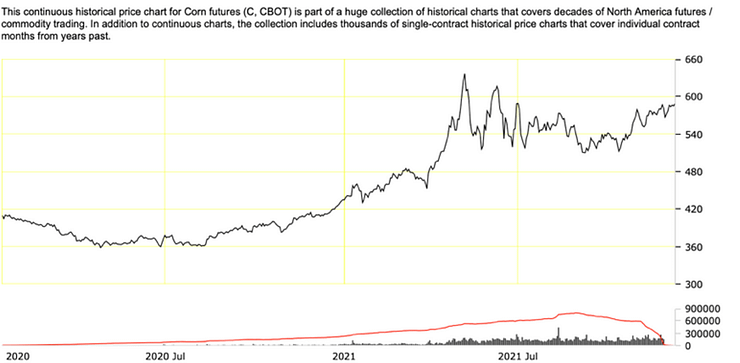

A review of price action in 2012 (Chart 1) and 2021 (Chart 2) shows similarities in the December futures charts and resulting lower prices achieved for the ASP contract. Rising prices ahead of harvest caused the ASP contract to capture a relatively lower price, since sales were made at lower prices earlier in the year.

Chart 1: December 2012 Corn Futures

Chart 2: December 2021 Corn Futures

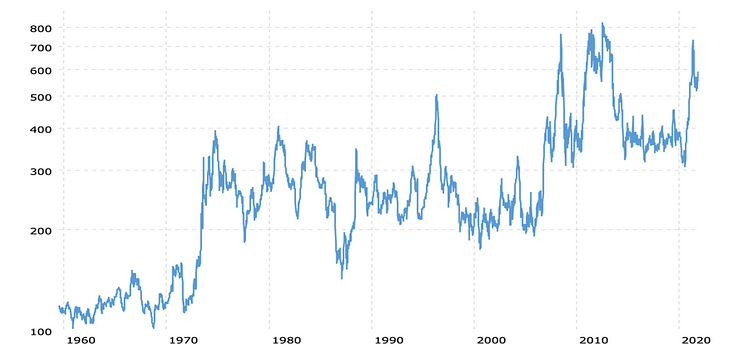

That said, price spikes are often followed by a rapid return to lower prices, including in 2013 and 2014 (Chart 3). During these years, the ASP contract dramatically exceeded the harvest Price, by $1.07/bushel and $1.30/bushel respectively.

Chart 3: Corn futures 1960-2021

No one knows whether corn prices will fall in 2022. They could continue higher on tight supplies and strong demand. But USDA currently projects crops will fetch notably lower prices on average in 2022 than 2021, thanks primarily to more planted acres and higher production.

In statistical tables issued in advance of its annual Outlook Forum in February, USDA projected corn will sell for a season-average $4.80 in 2022, down 65¢ from 2021.

The present

Given the USDA outlook and with corn futures currently near the top end of their historical range (Chart 3), protecting and capturing this price strength could be key to profitability in the new year. This is especially true given the expense side of the equation since input costs have risen significantly.

Producers can use an ASP contract to spread sales over months of uncertainty related to new-crop supply when prices tend to build in seasonal premiums to compensate for crop production threats. The contract allows sales over the entire period from February-June to determine a final price. But it also gives producers the flexibility to end the selling period early by pricing out of the contract at their discretion. For example, should market conditions deteriorate, a producer may decide to avoid potential further declines by capturing the average price to that point.

As with any forward pricing tool, ASP contracts should be used alongside corn marketing best practices to determine how much of the crop to price ahead. Some of these include:

- Know the breakeven to understand profit levels.

- Market up to amount of insurance coverage with a diversified approach.

- Bushels produced over the amount of insured coverage should be assessed as the crop year goes on. They can be priced ahead of harvest once the crop is made or held to be priced after harvest.

ASP ROI

10-year-average (2012-2021) = 4-cent investment, 12-cent average annual return = 3:1 ROI

9-year-average (2013-2021) = 4-cent investment, 36-cent average annual return = 9:1 ROI

Get Started

ASP contracts require a 4-cent-bushel investment, and the deadline to enroll is January 21, 2022. Contact your ADM representative to enroll a portion of your expected production in a contract that works best for your operation and marketing objectives.

ADM is providing this communication for informational purposes, and it is not a solicitation or offer to purchase or sell commodities. The recommendations in this communication do not take into account any particular individual’s or company’s objectives or needs, which should be considered before engaging in any commodity transactions based on these recommendations. The sources for the information and recommendations in this communication are believed to be reliable, but ADM does not warrant or guarantee the accuracy of the information or recommendations. ADM or its affiliates may hold or take positions for their own accounts that are different from the positions recommended in this communication. The information and recommendations in this communication are subject to change without notice.