Contract Choices

The Price Max contract can be applied to any existing or new contract today where the futures reference price is established, and for bushels to be delivered now or later.

You can work with your ADM representative to determine these components:

- A Price Max conditional offer price

- A Price Max target offer date

- The specific futures reference month associated with the target offer price

Note: The number of bushels on your Price Max conditional offer will be equal to the bushel quantity of your original contract. You keep the Price Max premium on your original bushel quantity no matter what.

Once these components are defined, your Price Max premium will be determined. When added to the market price, or your pre-existing contract price, if the premium meets your pricing objective, you can choose to enter into a Price Max contract. This means adding the agreement to offer the same bushel quantity, at a maximum price, to be delivered in the future — if your Price Max target offer is accepted on the target offer date.

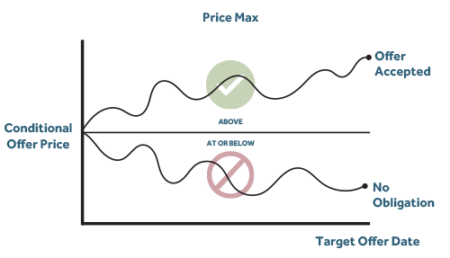

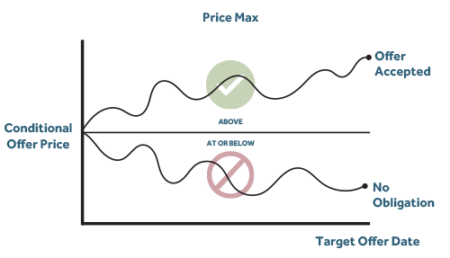

The Price Max target offer will be accepted if:

On the Price Max target offer date, the futures reference market associated with the conditional firm offer price settles above the Price Max target offer price. If accepted, you’ll receive a new contract for the bushel quantity that you committed to the original Price Max contract, at the agreed upon maximum futures reference price. You can work with your ADM representative to set basis per the terms on the contract.

The Price Max target offer will not be accepted if:

On the Price Max target offer date, the underlying futures reference market associated with the conditional offer price settles at or below the Price Max conditional offer price. Your offer expires and there is no additional bushel commitment.

The final cash price on your Price Max contract will always equal:

Futures Reference Price +/- Basis + Price Max Premium

When entering into a Price Max contract, it is important to evaluate the percentage of your crop that the Price Max conditional offer represents, and to have comfort with the Price Max conditional offer maximum price commitment. Remember, you will not know if your conditional offer price will be accepted or not until the target offer date.