Time Stamp Your Grain Marketing Plan

February 13, 2025

Time-stamped grain marketing is a tool for mitigating risk and planning for profit. By selling portions of your crop at intervals throughout the year, you may increase your chances

Sometimes it can be tough to make the decision to sell grain today, not knowing what the market will do in the future. Or, maybe you’ve made a few sales already, but the market has shifted and you want to be a participant again. In either case, ADM’s Price Point contract allows you to sell grain with confidence early on, knowing that you can re-take control based on your market opinion.

ADM products and services vary by location.

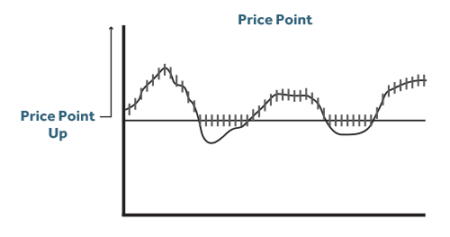

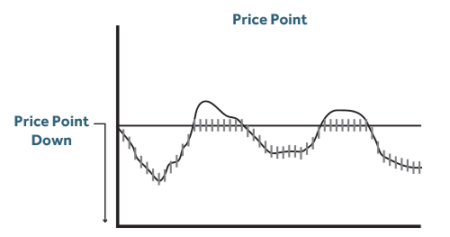

The Price Point contract offers the choice to participate in the market’s movement higher (Price Point – Up) or lower (Price Point – Down) relative to a Price Point that references a specific futures reference month. With both, you can decide how high or low to set your specific Price Point, and how much time going forward that you want to participate in the market.

Futures Reference Price +/- Basis

– Service Fee + Price Point Value (if any)

With a Price Point – Up contract, the Price Point level is defined with the help of your local ADM rep.

During the pricing period:

If the underlying futures reference market settles above the Price Point level, the market settlement price will be referenced for the daily pricing quantity on that day.

If the underlying futures reference market settles at or below the Price Point level, the Price Point level will be referenced for the daily pricing quantity on that day.

After the pricing period concludes:

The average of the daily pricings is determined by summing the daily prices and dividing by the number of days in the pricing period.

That average price minus the Price Point level determines what value, if any, will be added back to the contract.

The final cash price equals:

Futures Reference Price +/- Basis

– Service Fee + Price Point Value (if any)

With a Price Point – Down contract, the Price Point level is defined with the help of your local ADM rep.

During the pricing period:

If the underlying futures reference market settles below the Price Point level, the market settlement price will be referenced for the daily pricing quantity on that day.

If the underlying futures reference market settles at or above the Price Point level, the Price Point level will be referenced for the daily pricing quantity on that day.

After the pricing period concludes:

The average of the daily price references is determined by summing the daily price references and dividing by the number of days in the pricing period.

The Price Point level minus that average price determines what value, if any, will be added back to the contract.

The final cash price equals:

Futures Reference Price +/- Basis

– Service Fee + Price Point Value (if any)

February 13, 2025

Time-stamped grain marketing is a tool for mitigating risk and planning for profit. By selling portions of your crop at intervals throughout the year, you may increase your chances

December 9, 2024

Historical trends in the market make a strong case for forward selling. While there have been exceptions, history generally supports forward marketing. Since 2000, early crop-year futures have outperformed

October 15, 2024

What’s Ahead in 2025? As we look toward the 2025 crop year, the USDA projects a slight increase in corn and soybean production compared to 2024. However, global demand

August 20, 2024

“By taking emotion out of the sale, an offer is a good way to make sure you cross that goal line.” -Matthew Kroes, ADM Account Manager When it

August 16, 2024

While most of the hard work at harvest takes place in the field, there are other steps you can take to make life easier off the field and avoid

June 14, 2024

It’s never too early to start thinking about getting your bins ready for harvest. For many producers, grain bin prep and safety are always top of mind to ensure

February 15, 2024

Measurement is the key to performance evaluation, and targeted benchmarks will provide a built-in pathway to knowing whether you’re meeting, exceeding, or falling short of your goals. So, what

December 21, 2023

Both corn and soybean prices show signs of change, with pressure to trend lower, but, strong animal feed and renewable fuel demand might bring some relief. If so, when?

December 15, 2023

No matter the year, crop-input cost decisions will play a huge role in determining your profit outcomes. To help you succeed in your plans for next year’s crop, consider

November 1, 2023

Let’s face it. No matter what season it is, your farm operation will always demand more from your day than there are hours to do it. Knowing the value