Will Sliding Corn and Soybean Prices Reverse Course?

December 21, 2023

Both corn and soybean prices show signs of change, with pressure to trend lower, but, strong animal feed and renewable fuel demand might bring some relief. If so, when?

Rather than settle for the current market price, you can often achieve strategic price targets by using this unique contracting mechanism to establish your futures reference price. If prices go higher, you may sell additional bushels and if prices go much lower, pricing activity may stop altogether or trigger a minimum guaranteed futures reference price.

ADM products and services vary by location.

How it Works

Price Accumulator contracts offer the choice with a guaranteed minimum futures reference price (Guaranteed Price Accumulator) or without a guaranteed minimum futures reference price (Non-Guaranteed Price Accumulator). With both, you also get to choose whether you prefer the double-up feature to occur on a daily basis, or one time—on the final pricing day. In either case, your contracted bushels to be delivered will never be less than the original quantity or more than two times the original quantity.

Here’s how to put Price Accumulator to work for you:

Benefits

Details

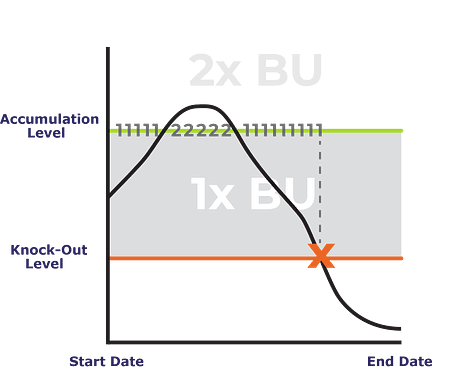

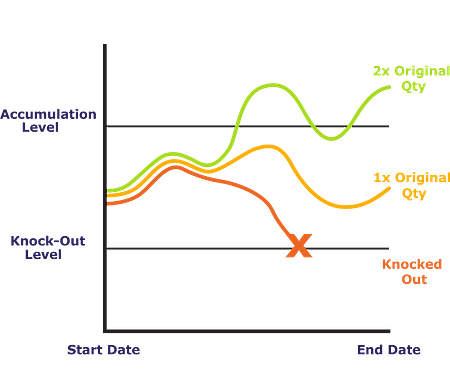

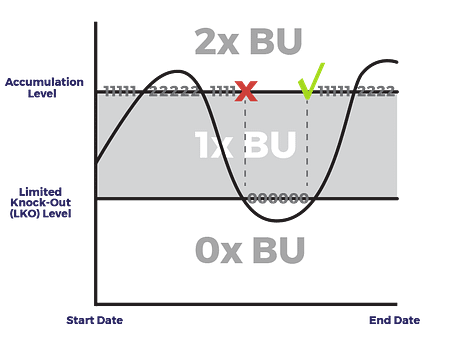

With the Non-Guaranteed Price Accumulator contract, Accumulation Levels and Knock-Out Levels are defined.

Daily Double-Up Feature

If the underlying futures market settles above the Knock-Out Level, at or below the Accumulation Level, one times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles above the Accumulation Level, two times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles at or below the Knock-Out Level, pricing stops. All priced quantities will be applied toward the original contract quantity and any unpriced balance will remain unpriced by the formula, but must be priced prior to delivery.

One Time Double-Up Feature

If the underlying futures market settles above the Knock-Out Level, one times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles at or below the Knock-Out Level, pricing stops and the one time double-up feature expires. All priced quantities will be applied toward the original contract quantity and any unpriced balance will remain unpriced by the formula, but must be priced prior to delivery. If the contract hasn’t knocked out, and on the final pricing day, the market settles above the Accumulation Level, an additional set of bushels, equal to the original quantity, will be priced at the Accumulation Level on that day.

How it Works

Price Accumulator contracts offer the choice with a guaranteed minimum futures reference price (Guaranteed Price Accumulator) or without a guaranteed minimum futures reference price (Non-Guaranteed Price Accumulator). With both, you also get to choose whether you prefer the double-up feature to occur on a daily basis, or one time—on the final pricing day. In either case, your contracted bushels to be delivered will never be less than the original quantity or more than two times the original quantity.

Here’s how to put Price Accumulator to work for you:

Benefits

Details

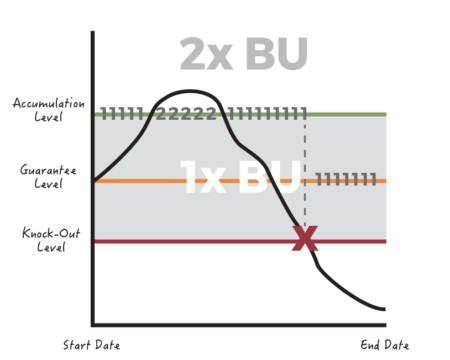

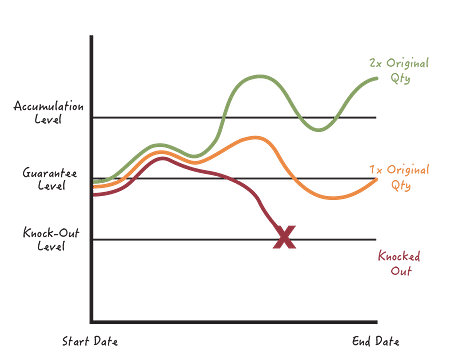

If you wish, you can add a Guaranteed minimum futures reference price to the Price Accumulator contract. In this option, if the futures market ever settles at or below the Knock-Out Level, any remaining daily pricing quantities will be priced at the Guaranteed price level. The Knock-Out, Guarantee, and Accumulation Levels will all be defined.

Daily Double-Up Feature

If the underlying futures market settles above the Knock-Out Level, at or below the Accumulation Level, one times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles above the Accumulation Level, two times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles at or below the Knock-Out Level, any remaining daily pricing quantities will be priced using the Guarantee Level.

One Time Double-Up Feature

If the underlying futures market settles above the Knock-Out Level, one times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles at or below the Knock-Out Level, the one time double-up feature expires, and any remaining daily pricing quantities will be priced using the Guarantee Level. If the contract hasn’t knocked out, and on the final pricing day, the market settles above the Accumulation Level, an additional set of bushels, equal to the original quantity, will be priced at the Accumulation Level on that day.

The Formula

How It Works

Benefits

December 21, 2023

Both corn and soybean prices show signs of change, with pressure to trend lower, but, strong animal feed and renewable fuel demand might bring some relief. If so, when?

March 16, 2022

In a volatile soybean market, the Average Seasonal Price (ASP™) contract can help lower stress levels.

April 9, 2020

There’s some comfort in routine right now. For producers, there’s another crop to plant, harvest, and distribute – and it all starts right now. One thing that’s not routine,

November 14, 2019

When conditions are tough, it’s natural for lower order thinking and survival instincts to kick in—like the brain of a squirrel in survival mode. Economists call these habits “heuristics”—bad

August 7, 2019

It’s mid-way through the growing season, with harvest around the corner. If you still have some bin bushels to clear out, you face marketing decisions on two crops—old and

April 4, 2019

The market is carefully watching news about corn and soybean acreage, planting delays from flooding, and trade news. Any one factor could quickly change price direction—or not. You need

February 14, 2019

Going into a new crop year, you need some early wins, and February gives you the perfect chance to do that. How? By locking in lower fertilizer prices while

January 16, 2019

It was a challenging 2018. The year started with positive news: projections of record soy demand and weather issues in Argentina. But then we had a perfect storm: a

December 6, 2018

Ready for some good news for a change? This was a challenging year for markets, but if seasonal trends hold true, we may have weathered the weakest months. Opportunities

November 8, 2018

A record harvest along with lingering trade uncertainty have weighed on markets. But as you continue to farm, there’s one thing you have to fall back on: discipline—doing the