Will Sliding Corn and Soybean Prices Reverse Course?

Both corn and soybean prices show signs of change, with pressure to trend lower, but, strong animal feed and renewable fuel demand might bring some relief. If so, when?

In addition to trying to time portions of your expected 2024 corn and soybean crop sales throughout the year to possibly hit top markets, also consider an ASP™ contract from ADM. ASP helps protect farm profitability and automatically capitalizes on periods when futures prices are historically price friendly.

This year we have optimized the ASP program to give you the best possible performance potential. Based on a robust, seven-year historical analysis, ASP enables producers to price expected production to capture the futures price for new-crop corn and soybeans during a seasonal, price-advantageous time period.

ASP also provides multiple, additional benefits. For example, it will:

- Automatically execute for you, minimizing stress, worry and emotional decision-making

- Allow you to set the basis when you want

- Provide an early, “price-out” feature so you maintain some control over final pricing

- Help diversify your marketing plan

- Establish a challenging benchmark to hit or surpass for your remaining crop marketing

Including ASP contracts in your marketing program will provide a framework to protect and enhance your farm’s revenue potential. Over time, ASP has delivered a strong return on investment (ROI) while also providing a benchmark for other grain marketing objectives.

Price-Friendly Corn and Soybean Futures

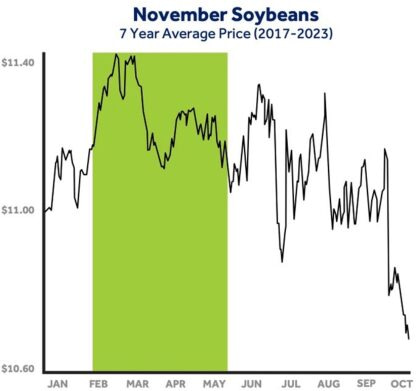

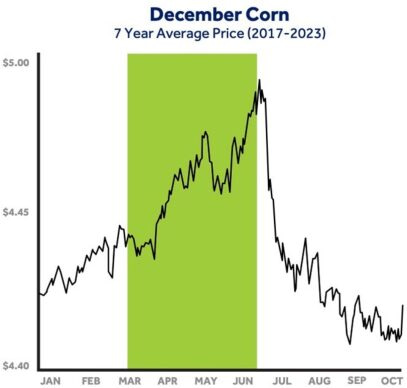

Below are charts showing the seven-year average futures prices from 2017 to 2023 for December Corn and November Soybeans. The shaded areas represent the months that regularly provide price-friendly opportunities.

These charts show the need for a consistent strategy for gains over time and for a diversified grain marketing portfolio to counter unexpected market fluctuations.

Producers can use an ASP contract to spread sales over months when new-crop supply uncertainties often prompt seasonal premiums to compensate for crop production threats. ASP contracts allow sales over the entire Pricing Window period (optimized now for either March through June for corn or February through May for soybeans) to determine a final price.

As with any forward-pricing tool, ASP contracts should be used alongside crop marketing best practices to determine how much to price ahead. These include:

- Know the breakeven to understand profit levels.

- Market up to insurance coverage amounts with a diversified approach.

- Assess bushels produced over the insured coverage amount as the crop year ensues. These bushels can be priced ahead of harvest, once the crop is made, or held to be priced after harvest.

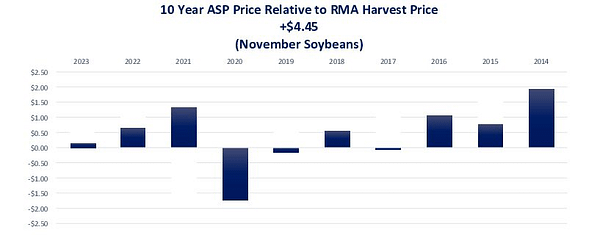

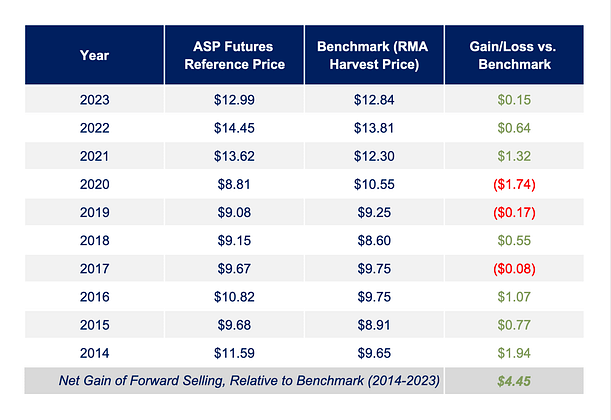

ASP’s ROI Boost for Soybeans

The most recent 10-year price period does provide indicators for future ASP soybean contract success, particularly if 2024 follows a more seasonal pattern. See the table below for 10-year ASP prices relative to USDA’s Risk Management Agency (RMA) harvest price for November Soybeans.*

From 2014-2023, a producer would have gained a total of $4.45 per bushel of soybeans by consistently participating in ASP. So, if you raised 50-bushel soybeans on 1,000 acres, ASP would have garnered $22,250 more per year, or $222,500 more over 10 years!

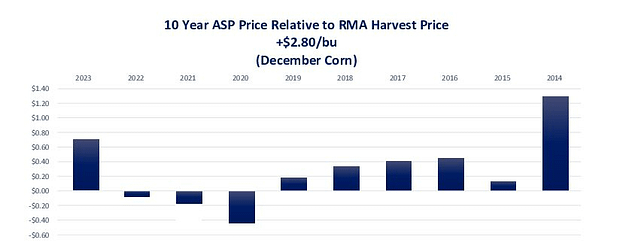

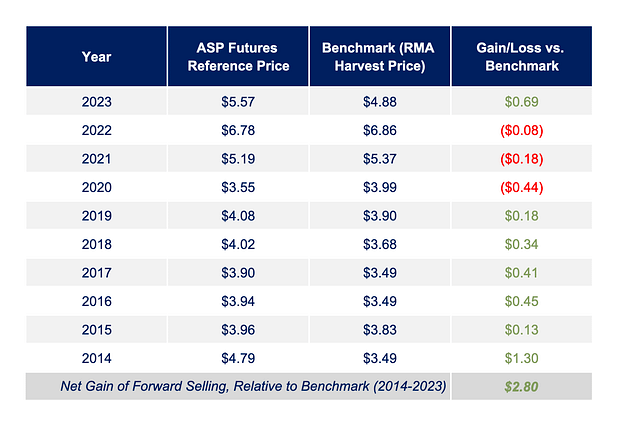

ASP’s ROI Boost for Corn

Again, past performance won’t guarantee future returns, but the most recent 10-year corn price period does provide indicators for future success as well. See the table below for 10-year ASP prices relative to the RMA harvest price for December Corn.

From 2014-2023, a corn grower would have gained a total of $2.80 per bushel by sticking to the ASP contract strategy versus selling at harvest. That’s an average of 28-cents/bushel more per year. So, if you raised 200-bushel corn on 1,000 acres, ASP would have provided you $56,000 more per year, or $560,000 more over 10 years!

ASP Early Price Out

Producers who enroll in ASP have the opportunity to price out early to provide flexibility over final pricing. For example, should market conditions start to weaken, a producer may decide to avoid potential further declines by capturing the average price up to that point. Early price out is free, available any time, and subject to current market prices to determine final value.

Enroll by January 26, 2024

ASP corn contracts require a 4-cent per-bushel investment, the new Pricing Window is from March 4 through June 14, and the deadline to enroll is January 26, 2024. Similarly, the ASP soybean contracts require a 5-cent per-bushel investment, the new Pricing Window is from February 5 through May 17, and the deadline to enroll is also January 26, 2024.

Contact your ADM representative to enroll a portion of your expected production in a contract that works best for your operation and marketing objectives.

*According to USDA, RMA harvest price is “a price determined in accordance with the Commodity Exchange Price Provisions and used to value production to count for revenue protection.”

ADM is providing this communication for informational purposes, and it is not a solicitation or offer to purchase or sell commodities. The sources for the information in this communication are believed to be reliable, but ADM does not warrant the accuracy of the information. The information in this communication is subject to change without notice. If applicable, any information and/or recommendations in this communication do not take into account any particular individual’s or company’s objectives or needs, which should be considered before engaging in any commodity transactions based on these recommendations. ADM or its affiliates may hold or take positions for their own accounts that are different from the positions recommended in this communication.