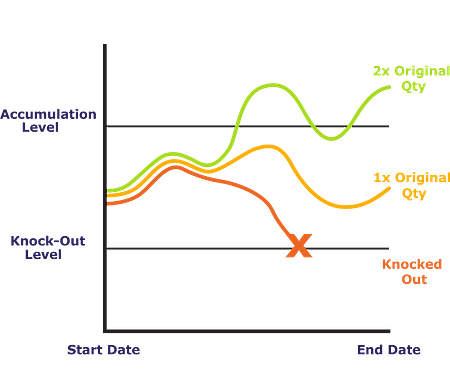

Non-Guaranteed Contract

How it Works

Price Accumulator contracts offer the choice with a guaranteed minimum futures reference price (Guaranteed Price Accumulator) or without a guaranteed minimum futures reference price (Non-Guaranteed Price Accumulator). With both, you also get to choose whether you prefer the double-up feature to occur on a daily basis, or one time—on the final pricing day. In either case, your contracted bushels to be delivered will never be less than the original quantity or more than two times the original quantity.

Here’s how to put Price Accumulator to work for you:

- You choose the number of bushels you want to price, the time period in which pricing for a specific commodity will occur and a delivery period.

- You decide if you would like to add a Guaranteed Price Level to the Price Accumulator contract, and choose your double-up feature.

- When the pricing period concludes, the final futures reference price will be established on your contract by summing the daily pricings and quantities according to the formula in place.

- Prior to grain delivery, you set the basis.

- You deliver your contracted grain and receive the final cash price, which is the Final Futures Reference Price +/– Basis – Service Fee + Premium Paid (if any).

Benefits

- Helps achieve target price levels that may not otherwise be achievable.

- Forward marketing can help you mitigate risk, making it a critical component to your overall marketing portfolio.

- The Guaranteed Price Accumulator choices assure a minimum futures reference price for your grain.

- It automatically executes for you, minimizing stress and worry.

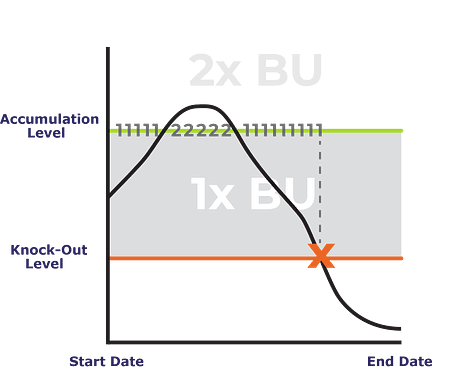

Details

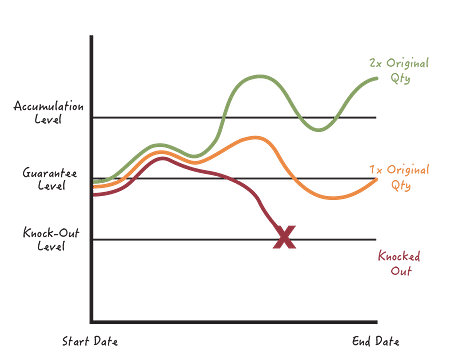

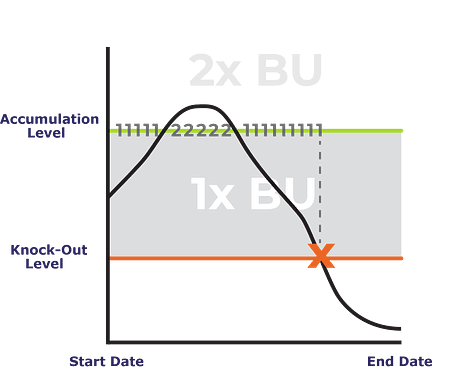

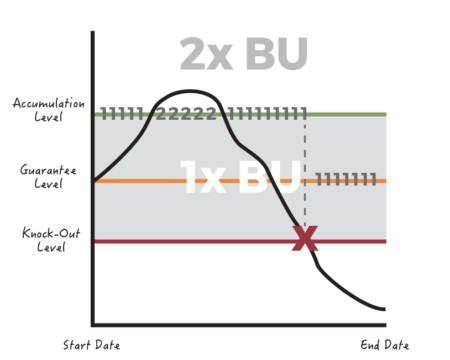

With the Non-Guaranteed Price Accumulator contract, Accumulation Levels and Knock-Out Levels are defined.

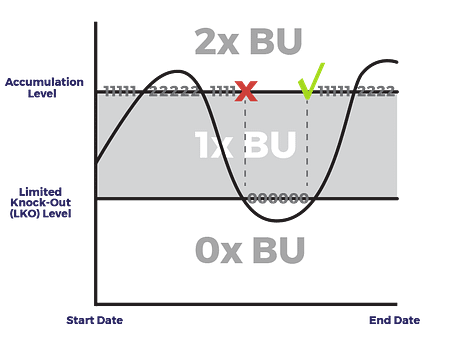

Daily Double-Up Feature

If the underlying futures market settles above the Knock-Out Level, at or below the Accumulation Level, one times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles above the Accumulation Level, two times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles at or below the Knock-Out Level, pricing stops. All priced quantities will be applied toward the original contract quantity and any unpriced balance will remain unpriced by the formula, but must be priced prior to delivery.

One Time Double-Up Feature

If the underlying futures market settles above the Knock-Out Level, one times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles at or below the Knock-Out Level, pricing stops and the one time double-up feature expires. All priced quantities will be applied toward the original contract quantity and any unpriced balance will remain unpriced by the formula, but must be priced prior to delivery. If the contract hasn’t knocked out, and on the final pricing day, the market settles above the Accumulation Level, an additional set of bushels, equal to the original quantity, will be priced at the Accumulation Level on that day.

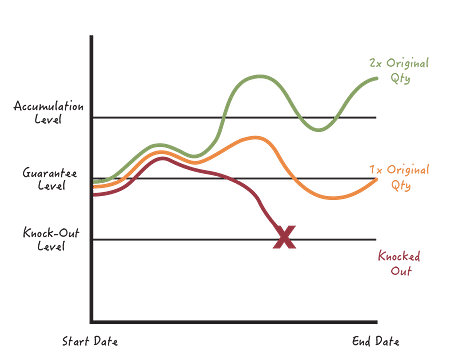

Guaranteed Contract

How it Works

Price Accumulator contracts offer the choice with a guaranteed minimum futures reference price (Guaranteed Price Accumulator) or without a guaranteed minimum futures reference price (Non-Guaranteed Price Accumulator). With both, you also get to choose whether you prefer the double-up feature to occur on a daily basis, or one time—on the final pricing day. In either case, your contracted bushels to be delivered will never be less than the original quantity or more than two times the original quantity.

Here’s how to put Price Accumulator to work for you:

- You choose the number of bushels you want to price, the time period in which pricing for a specific commodity will occur and a delivery period.

- You decide if you would like to add a Guaranteed Price Level to the Price Accumulator contract, and choose your double-up feature.

- When the pricing period concludes, the final futures reference price will be established on your contract by summing the daily pricings and quantities according to the formula in place.

- Prior to grain delivery, you set the basis.

- You deliver your contracted grain and receive the final cash price, which is the Final Futures Reference Price +/– Basis – Service Fee + Premium Paid (if any).

Benefits

- Helps achieve target price levels that may not otherwise be achievable.

- Forward marketing can help you mitigate risk, making it a critical component to your overall marketing portfolio.

- The Guaranteed Price Accumulator choices assure a minimum futures reference price for your grain.

- It automatically executes for you, minimizing stress and worry.

Details

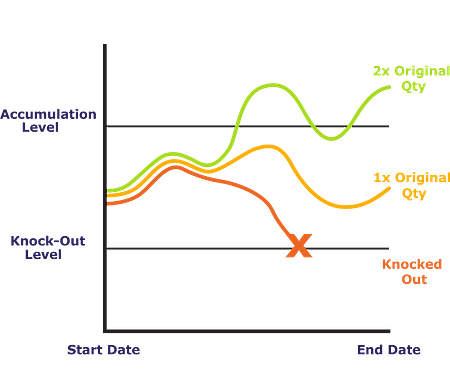

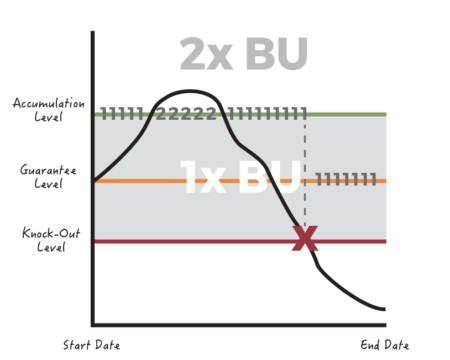

If you wish, you can add a Guaranteed minimum futures reference price to the Price Accumulator contract. In this option, if the futures market ever settles at or below the Knock-Out Level, any remaining daily pricing quantities will be priced at the Guaranteed price level. The Knock-Out, Guarantee, and Accumulation Levels will all be defined.

Daily Double-Up Feature

If the underlying futures market settles above the Knock-Out Level, at or below the Accumulation Level, one times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles above the Accumulation Level, two times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles at or below the Knock-Out Level, any remaining daily pricing quantities will be priced using the Guarantee Level.

One Time Double-Up Feature

If the underlying futures market settles above the Knock-Out Level, one times the daily pricing quantity will be priced at the Accumulation Level on that day. If the market settles at or below the Knock-Out Level, the one time double-up feature expires, and any remaining daily pricing quantities will be priced using the Guarantee Level. If the contract hasn’t knocked out, and on the final pricing day, the market settles above the Accumulation Level, an additional set of bushels, equal to the original quantity, will be priced at the Accumulation Level on that day.