What Can Forward Marketing Do for Your Operation?

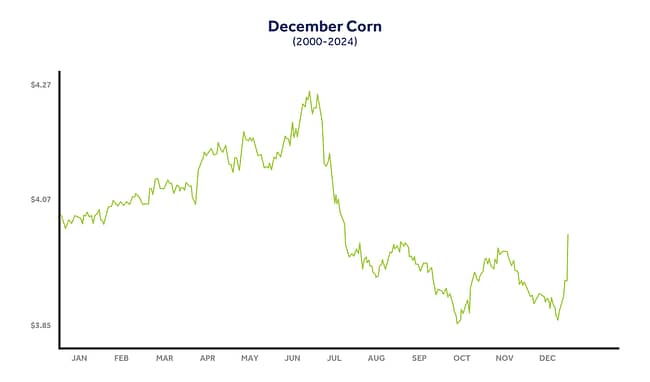

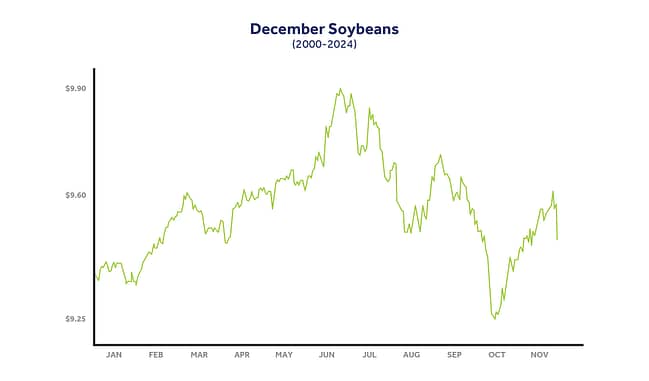

Historical trends in the market make a strong case for forward selling. While there have been exceptions, history generally supports forward marketing. Since 2000, early crop-year futures have outperformed harvest prices by 79% of the time for corn and 71% of the time for soybeans. Despite weather years like 2012 making some farmers hesitant to sell early, ADM Account Manager Todd Burda offers some advice: “Trying to guess what the weather will do year to year, let alone the markets, is nearly impossible. Staying disciplined with marketing will provide the most success year over year. Just because one event happened last year does not mean it will happen the next year.”

It’s important to approach forward marketing as part of a comprehensive risk management strategy. Balancing the potential benefits against the risks of yield uncertainty and exceptional market events is key to successful agricultural marketing. Todd further explains, “Marketing grain can create a lot of emotions and stress, but having a plan can help reduce the emotions and stress. From my experience, the most successful farmers are the ones who stay disciplined in their marketing approach. This might be as simple as having a plan to sell on certain dates during the year or putting in offers to sell at price targets or even utilizing different mechanical contracts to make sure they have some forward sales going into harvest.”

“Having a plan every year will increase your chances of making good forward sales.”

– Todd Burda, ADM Account Manager

Benefits:

- Lock in Margins

Forward marketing allows you to lock in margins months in advance, thereby allowing your crop to grow or be stored in the bin with some security regarding your return on investment. “Investing the time to calculate your break-even can be a tedious process, but it can provide a lot of value. Having an understanding of what price your farm needs can significantly improve your marketing plan. When the market gives you an opportunity above your break-even, you can sell with more confidence, knowing it is a profitable sale for your operation. Unfortunately, the market may not provide opportunities to sell above your break-even, but knowing your numbers can still allow you to make sales based on your operation’s needs,” says Todd. Your ADM representative can help walk you through the process of calculating your break-even.

- Sell in Increments

“In a perfect world, we would sell all our production at the high, but that seems like an unrealistic goal. Instead, having a plan to make incremental grain sales will allow you to reward the market in volatile times,” says Todd. Your plan can range in simplicity or complexity, depending on the needs of your operation. Todd further explains, “A marketing plan can reduce the pressure to act impulsively or fear of missing the ‘high of the market’. I like to tell farmers if your first sale is your worst sale that isn’t necessarily a bad thing. You should want the market to go higher even after you make a sale. This will allow for additional opportunities to make sales at higher prices.”

- Plan Around Historical Trends

Early in the production year, grain markets are typically volatile due to uncertainty about the new crop, with prices historically peaking in February, March, and April before declining toward harvest if conditions are favorable. Market seasonality typically shows another peak between mid-June and early July, coinciding with the period when potential supply problems become evident through yield assessments. The most uncertain period occurs during pollination, when factors like moisture, plant height, and weather forecasts greatly influence market prices. This often leads to a “worst-case scenario” being priced in early. As the growing season progresses, the market eventually reaches a point where the crop’s potential is fully factored in, resulting in prices typically fading from late July through September as the market enters a “wait-and-see” phase. To navigate these market dynamics, it’s crucial to develop a marketing plan and consider forward contracting earlier in the season.

Ways to Begin:

- The simplest way to forward contract is through a fixed price (cash) contract, which locks in both the futures price and basis.

- After fixed-price sales, you can consider a hedge-to-arrive (HTA) contract, where you lock in a futures price but set the basis later. Or a basis contract to do the opposite: lock in the basis now and set the futures reference price later.

- If you want to lock in a margin but the current price isn’t quite where you want it, consider talking to your ADM representative about establishing some offers.

- For those looking for a strategic approach to pricing corn or soybeans during historically favorable periods, ADM’s Seasonal Price contract offers a tailored solution.

- To compare and evaluate various marketing methods, you can refer to ADM’s Grain Contract Comparison Chart, which provides a comprehensive overview of all the different contract types available to you.

Contact Your ADM Representative Today

To see how forward marketing can benefit your operation, contact your local ADM representative. We would be pleased to walk you through all your options, ensuring you fully understand the associated risks and benefits.