Maximize Your Potential: Strategically Price Your Corn and Soybeans with ADM’s Seasonal Price Contract

ADM’s Seasonal Price contract offers a strategic solution to price your corn or soybean production during historically favorable periods. It allows you to capture potential market opportunities by automatically pricing an equal portion of bushels across months when uncertainties in new-crop supply typically result in seasonal price premiums. Plus, you’re able to price out early so you can maintain some control of your final futures price. This contract is designed to execute automatically, allowing you to focus on planting and other critical farm operations.

With ADM’s Seasonal Price contract, you can take advantage of several key benefits:

- Diversifying your grain marketing portfolio

- Leveraging an automatic execution component in your grain pricing program

- Capturing seasonal price advantages

- Maintaining the control to “price out” if you see prices trending lower

Including ADM’s Seasonal Price contracts in your grain marketing program can provide a framework to protect and enhance your operation’s revenue potential. Over time, the Seasonal Price contract has delivered a strong return on investment (ROI) when compared to the RMA harvest price.

Historically Favorable Windows

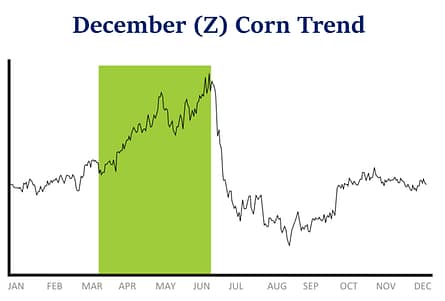

The shaded areas in the charts below represent the months that typically provide opportunities for corn and soybean futures:

December (Z) Corn

11-Year Market Trend from 2014 to 2024.

November (X) Soybeans

8-Year Market Trend from 2017 to 2024.

These charts demonstrate the need for a consistent strategy to capture gains over time and maintain a diversified grain marketing portfolio to counter unexpected market fluctuations.

Producers can use ADM’s Seasonal Price contract to spread sales across these months when new-crop supply uncertainties often lead to seasonal premiums, compensating for potential crop production risks.

ROI Boost for Corn and Soybeans

Over the past 12 years, the Seasonal Price corn contract has had a price premium over the USDA’s Risk Management Agency (RMA) harvest price for December (Z) corn 75% of the time.

In the most recent 9-year period, the Seasonal Price soybean contract has had a price premium over the RMA harvest price for November (X) soybeans 55% of the time.

Past performance is not indicative of future results. ADM does not warrant this information to be free of omissions and errors.

Best Practices for Forward-Pricing

As with any forward-pricing tool, Seasonal Price contracts should be used alongside crop marketing best practices:

- Know your breakeven to understand profit levels

- Market up to insurance coverage amounts with a diversified approach

- Assess bushels produced over the insured coverage amount as the crop year progresses

- Plan ahead for harvest delivery, as harvest normally yields the lowest price for your grain

New Option

- You now have the option to enroll a portion of your 2027 crop to be priced during the 2026 pricing window. This allows you to take advantage of the historically favorable period, a year earlier.

Early Price-Out Option

Producers enrolled in the Seasonal Price contract have the opportunity to price out early, providing flexibility over final pricing. This option is free, available at any time, and subject to current market prices.

Take The Next Step

Corn December (Z) Futures:

- Sign-Up Deadline: February 27,2026

- Pricing Window: March 16 through June 18,2026

- CZ26 Investment: 4-cent per bushel

- CZ27 Investment: 6-cent per bushel

Soybean November (X) Futures:

- Sign-Up Deadline: December 19,2026

- Pricing Window: January 5 through April 24,2026

- SX26 Investment: 5-cent per bushel

- SX26 Investment: 7-cent per bushel

Learn More

Contact your ADM representative to enroll a portion of your expected production in a contract that works best for your operation and grain marketing objectives.

Locate your nearest ADM elevator by entering your zip/postal code or city on the Contact Us page.

ADM is providing this communication for informational purposes, and it is not a solicitation or offer to purchase or sell commodities. The sources for the information in this communication are believed to be reliable, but ADM does not warrant the accuracy of the information. The information in this communication is subject to change without notice. If applicable, any information and/or recommendations in this communication do not take into account any particular individual’s or company’s objectives or needs, which should be considered before engaging in any commodity transactions based on these recommendations. ADM or its affiliates may hold or take positions for their own accounts that are different from the positions recommended in this communication.