Locking in Price Floors with Upside Opportunities

Just as a diversified retirement portfolio is important for investors, a diversified grain marketing plan is essential for producers. While no strategy is perfect in every environment, a well-rounded approach can help producers navigate market volatility more smoothly.1 Stability of income and effective risk management are key objectives of a strategic grain marketing plan. Adam Betancourt, ADM Risk Manager, provided some feedback on the current environment. “Current market conditions are rampant with uncertainty, making navigation of the market even more difficult. Opportunities in future grain markets may be different than in previous years.”

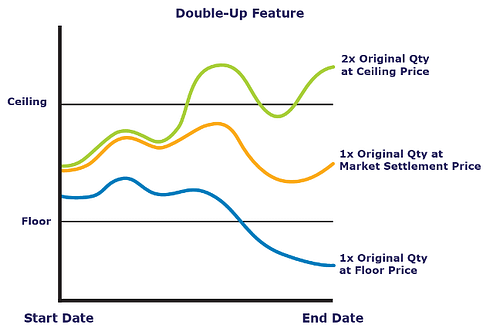

ADM’s 1×2 and Guaranteed Accumulator contracts help you establish a safety net price (floor) for a specific number of bushels. In return for this floor price, these contracts also set a maximum price limit (ceiling). Additional bushels may be priced at this predetermined ceiling price, but only if the market price exceeds that level when the contract expires. While this introduces some pricing risk, as you won’t know if the “double-up” will occur until expiration, it comes with the advantage of a guaranteed minimum price. For example, if you enroll 5,000 bushels, up to 10,000 bushels could potentially be priced at the predetermined ceiling.

These contracts may be a strong tool for producers who want to protect their downside risk while also having the opportunity to sell more grain if the market rallies. Jason Depenbrock, ADM Account Manager, likes to present these contracts to producers who are looking 8 months to even 2 years ahead in their grain marketing.

“These are the producers who are starting to look ahead and have ideas on what kind of values will work for them. I ask questions like, ‘What kind of hedge level are you looking for?’ and ‘What sort of floor are you looking at securing?’ This helps generate further conversation and customize the contract specifically to their operation and needs. Some producers use these tools to go back to their lenders and say, ‘Hey, we will have X sold at these specific levels.’”

How it Works: The Futures Reference Price will be established on your contract on the final pricing date you specified. If the market settles:

- Above your ceiling price, then double the original contract quantity will be priced at the ceiling price.

- At or below your ceiling price but above your floor price, then the original contract quantity will be priced at the market settlement price.

- Below your floor price, then the original contract quantity will be priced at your floor price.

Betancourt states, “These products are best positioned after a market rally, allowing you to protect an important level for your business, such as a break-even cost. While the floor is in place, the 1×2 contract also allows you to participate in upward market moves up to the ceiling level. Although upside participation is limited, a well-positioned 1×2 contract ideally has the ceiling level set at a point where you are interested in selling more bushels.”

The Benefits:

- Ensures a minimum futures reference price for your grain.

- Helps you achieve target price levels regardless of subsequent market conditions.

- Offers upside potential while protecting you from downside risk.

- Executes automatically on the pricing date.

- Provides certainty on a portion of your grain production.

- Once enrolled, the contract automatically executes.

Guaranteed Accumulator Contract

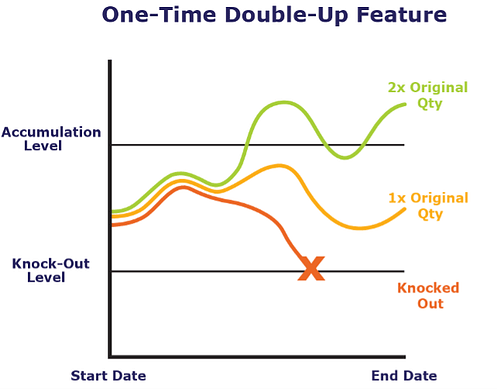

This contract helps you set a futures reference price while allowing you to choose between daily or one-time double-up features. Your delivered bushels will always be between the original quantity and twice that amount. For simplicity, we’ll focus on Guaranteed Accumulators with a One-Time Double-Up Feature.

How it Works: If the underlying futures market settles:

- Above the Knock-Out Level, one time the daily pricing quantity will be priced at the Accumulation Level on that day.

- At or below the Knock-Out Level, the one-time double-up feature expires, and any remaining daily pricing quantities will be priced using the Guarantee Level.

- If the contract hasn’t been knocked out, and on the final pricing day, the market settles above the Accumulation Level, an additional set of bushels, equal to the original quantity, will be priced at the Accumulation Level on that day.

Betancourt explains, “The ideal scenario for using this product is when you can secure a guarantee that protects an important level, such as a breakeven price, while also obtaining an attractive upfront price on the upside. This combination provides both security and the potential for higher returns.”

The Benefits:

- Helps achieve target price levels that may not otherwise be achievable.

- Offers upside potential while protecting from downside risk.

- Provides certainty on a portion of your grain production.

- Once enrolled, the contract automatically executes.

Comparing 1×2 and Guaranteed Accumulator Contracts

In summary, both 1×2 and Guaranteed Accumulator contracts serve similar purposes but have key differences in how they function. The 1×2 contract locks in a price floor but only finalizes at expiration, allowing for a potential upside if the market rises. In contrast, the Guaranteed Accumulator prices above the current market right away but includes a knockout (KO) feature that could trigger at any time, setting the price at the guarantee level if the market drops below a certain point.

Ultimately, the choice between these contracts depends on your risk tolerance and market outlook. Those seeking immediate pricing and a set guarantee may prefer the Guaranteed Accumulator, while those looking for potential upside participation might lean toward the 1×2 contract. Understanding these distinctions can help you make more informed grain marketing decisions.

1Market conditions may vary. ADM is not providing any tax or financial planning advice to customers.

ADM is providing this communication for informational purposes, and it is not a solicitation or offer to purchase or sell commodities. The sources for the information in this communication are believed to be reliable, but ADM does not warrant the accuracy of the information. The information in this communication is subject to change without notice. If applicable, any information and/or recommendations in this communication do not take into account any particular individual’s or company’s objectives or needs, which should be considered before engaging in any commodity transactions based on these recommendations. ADM or its affiliates may hold or take positions for their own accounts that are different from the positions recommended in this communication.