What can the dollar tell you about the future of corn and soybean prices?

Commodity prices take their direction from many factors. One price influence that is often misunderstood is the strength of the U.S. dollar. Historically, when the dollar is stronger, commodity prices are weaker. And vice versa. It’s typically an inverse relationship.

This is because major commodities around the world are priced in dollars. When the dollar is strong, a euro or peso or yuan has less value, so it takes more of them to buy a bushel of corn. This, in turn, can contribute to weakened demand.

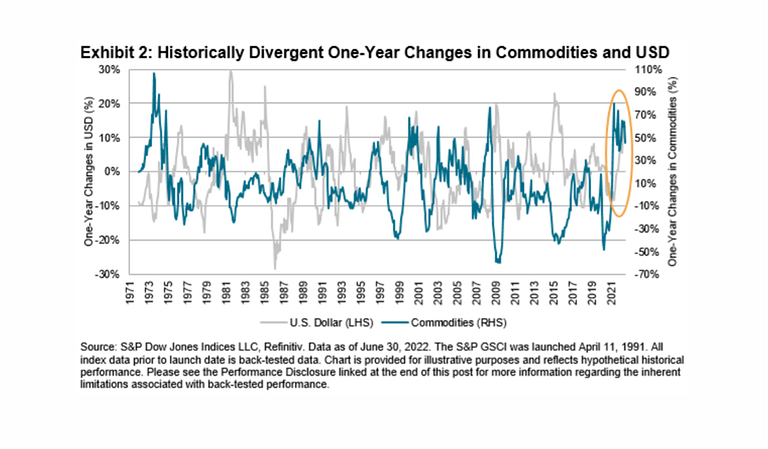

This chart compares the U.S. Dollar Index with the Bloomberg Commodity Index, a common benchmark index for commodity performance. It illustrates that when the dollar falls, commodity prices tend to rise, all else equal, with the reverse occurring in periods of dollar strength.

Recent Relationship

The value of the dollar also is influenced by many factors, and it rose to a 20-year high in 2022. Despite this strength, however, commodities prices remained high, going against the traditional relationship. In this case, commodities prices moved up first, and the dollar strength came later in response to an abrupt switch in policy by the U.S. Federal Reserve. To cool inflation, the Fed aggressively raised interest rates throughout the year.

Since late last year, U.S. economic data has shown that inflation has started to ease, and the U.S. economy is slowing. As a result, the market indicates that the U.S. Federal Reserve might slow its rate hikes, which would tend to cool the red-hot U.S. dollar.

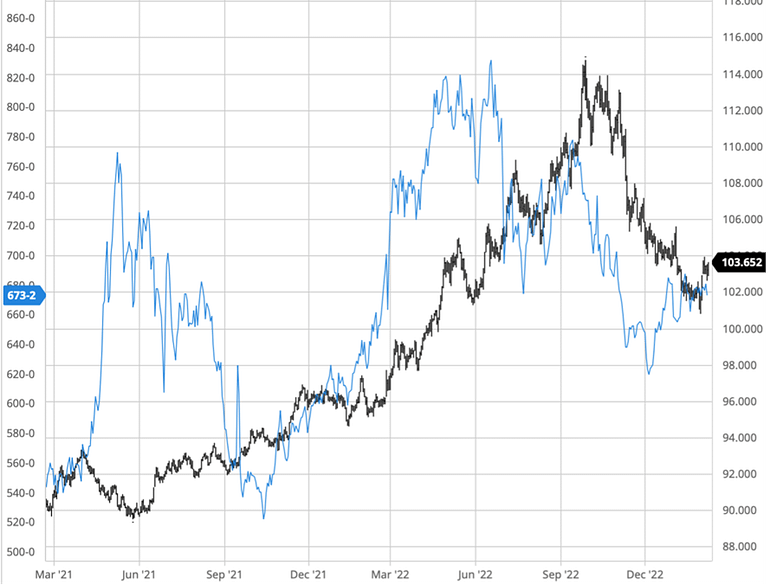

A two-year chart of cash corn prices vs the U.S. Dollar Index shows how the two had risen together starting in the fall of 2021 through much of 2022. They then turned weaker toward the end of the year. But as the dollar continued to sink, corn began to show signs of strength in December.

Is this a return to the historical relationship? No one knows for sure. But historically a lower U.S. dollar is supportive for corn prices.

The price of corn rose in early 2022, despite a strengthening U.S. Dollar. Corn prices began to fall as the dollar reached its peak, and then rose again as the dollar weakened late in the year.

What Now?

There are many uncertainties in the months ahead that could drive grain market strength or weakness, including the value of the dollar. Fortunately, there are grain marketing tools available for producers to use to offset volatile prices.

For example, a Minimum Price contract could be considered if you are optimistic about future price direction. An Minimum Price contract allows you to establish a price minimum (or floor), but if the market rallies you still have the ability to participate and add value back to the sale you made.

There are many types of minimum price contracts you can utilize. Work with your ADM grain origination representative to help guide you to those that best fit your objectives.

ADM is providing this communication for informational purposes, and it is not a solicitation or offer to purchase or sell commodities. The sources for the information in this communication are believed to be reliable, but ADM does not warrant the accuracy of the information. The information in this communication is subject to change without notice. If applicable, any information and/or recommendations in this communication do not take into account any particular individual’s or company’s objectives or needs, which should be considered before engaging in any commodity transactions based on these recommendations. ADM or its affiliates may hold or take positions for their own accounts that are different from the positions recommended in this communication.