A Bright Future for Soybean Demand

You’ve probably heard of renewable diesel, but what you may not know is how it could potentially influence the soybean market in the future. Demand is booming for this alternative fuel, and its effects are being felt across the markets for soybeans and soy products.

Renewable diesel is fundamentally different from biodiesel, which has been around for years. Unlike biodiesel, renewable diesel doesn’t need blending to be used. In fact, it can serve as a straight up replacement for petroleum diesel.

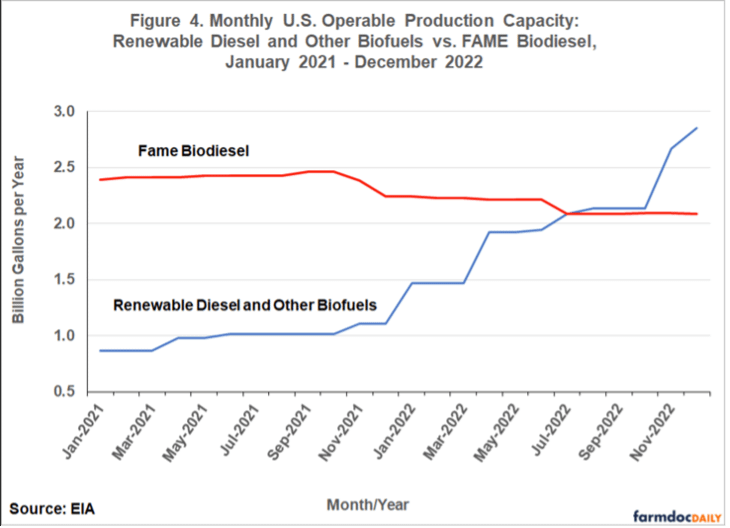

This fact has brought several major petroleum companies into the ag industry with serious investments to increase production of this promising fuel. In just two years, renewable diesel production nearly tripled from less than 1 billion gallons per year to nearly 3 billion gallons, passing biodiesel in gallons produced last year (see chart 1).

Chart 1

To meet this new demand for soy oil, companies like ADM are expanding their crushing capacity in the U.S.

Policies for production

Government policy has resulted in programs such as the U.S. Renewable Fuels Standard (RFS), which requires a certain amount of renewable fuel to replace or reduce the quantity of petroleum-based fuel. This program has been supplemented by others, including the Low Carbon Fuel Standard (LCFS) in California, which provides economic incentives for expansion of renewable fuel production.

As a result, new plants are being built and old ones renovated and expanded to increase production. Because renewable diesel can be refined in the same manner as crude oil, major petroleum companies have come to the table.

These companies have found that a supply of feedstocks such as soy oil is the biggest limiting factor to increased renewable diesel production. To address this shortfall, they’ve formed partnerships with companies like ADM to source soy oil for refining. ADM is constructing a new soybean crushing facility in Spiritwood, ND, which is expected to come online in October. This facility is part of a joint venture with Marathon, and the oil from this facility will help feed its refinery in Dickinson, ND.

This venture is one of many in the works. In the next four years, there are 21 planned crushing facilities in the U.S. with the capacity to utilize 754 million bushels of soybeans. That amount represents 17% of 2022 soybean production of 4.28 billion bushels.

Much of the activity is focused in the northwestern Midwest, including the Dakotas, Iowa and Nebraska, says Kirstie Anderson, ADM export trader. This region allows convenient rail access to export markets. “In the past, the focus for demand was in southeastern U.S. poultry markets, but we’re seeing a shift in plants to meet new demand source for soybeans,” she explains. “We now refine the oil domestically and hit export channels for meal.”

Shifts in acres, shifts in exports

Anderson says all this new crushing capacity will lead to ripple effects across the U.S. soybean industry.

The most obvious change will be growth in soybean acres, Anderson says. “Soybean ground is likely to eventually expand when this crush is realized.”

Exports have long been an important source of demand for U.S. soybeans, and that will continue, but with a different make up she says. “Domestic needs will be served first to satisfy demand for oil, and more soymeal is likely to be exported,” Anderson says.

It’s likely that fewer soybean sales will be made to China and fewer Pacific Northwest soybean exports overall. “This is because new soybean crushing capacity in the upper Midwest will absorb beans that used to go for export,” she adds.

While exporting soymeal is a logical outlet for excess supply, soymeal is more difficult to handle than grain, so it has the potential to create logistical bottlenecks. “For example, it takes less than one day to unload a unit-train of grain, but it takes two days for soymeal,” she explains. “There will need to be improvements made along the supply chain to better handle and store soymeal.”

Local impacts for producers

With change comes challenges but also opportunities. Anderson says producers should begin to see positive developments at the local level as new crushing facilities come online.

- Where there’s a heavy presence of crush plants, it’s likely that local cash market dynamics may create situations that incentivize more bean acres. Strength in the local basis could help sway contracted acres to soybeans versus other crops.

- Producers will notice infrastructure improvements where they deliver beans as companies invest in their facilities. Long lines and slow unloads hurt the competitiveness of older plants, so upgrades will be necessary for them to compete. This will result in a better delivery experience for producers.

- Advancements in soybean seed technology will focus on improving yields per acre, oil content, and in some cases protein. Producers may see more opportunities to enroll in specialty programs as new soy technology develops.

More Information

Anderson recently presented “Crush Expansion” during the monthly ADM Back 40 Grain Market Call. Text the word DAILY to 833-612-0869 to the daily market text and get notified for the next Back 40 Grain Marketing Call.

Farmdoc Daily is from the University of Illinois, and it offers articles and information on many farm topics, including renewable diesel: farmdocdaily.illinois.edu/category/areas

As always, reach out to your ADM representative with questions or check out ADMadvantage.com for valuable information.

ADM is providing this communication for informational purposes, and it is not a solicitation or offer to purchase or sell commodities. The sources for the information in this communication are believed to be reliable, but ADM does not warrant the accuracy of the information. The information in this communication is subject to change without notice. If applicable, any information and/or recommendations in this communication do not take into account any particular individual’s or company’s objectives or needs, which should be considered before engaging in any commodity transactions based on these recommendations. ADM or its affiliates may hold or take positions for their own accounts that are different from the positions recommended in this communication.